Customer Intelligence

Act on Insights, Not Instincts

Enrich your customer profiles with ongoing, proactive data insights that help you truly understand their financial needs and goals, identify critical moments to engage high-quality opportunities, and fuel long-term growth.

Schedule a demo

CREATE BETTER OUTCOMES

Proven results for lenders, banks, and credit unions

Explore case studies

features

Your data knows what customers want. Do you?

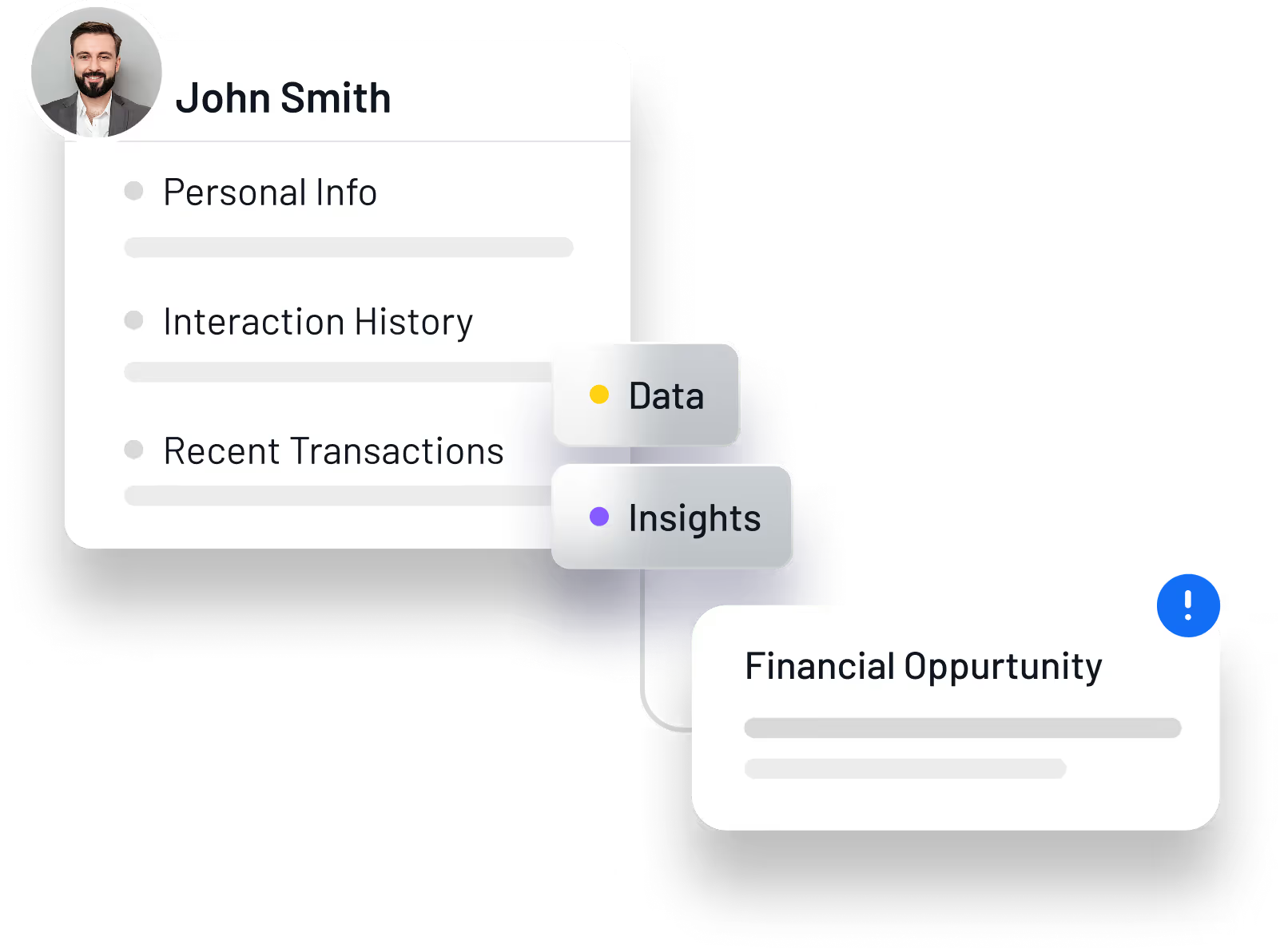

Profile Enrichment

Data is useful.

Knowing how to wield it is powerful.

Knowing how to wield it is powerful.

Create robust customer profiles that support personalized, authentic communications by combining your existing data with aggregated, publicly available third-party data.

Continuous data aggregation

Automatically pull in the latest available data to save time and help you identify customers with a financial need.

Holistic contact records

Build more robust profiles for every customer so you can engage them in authentic conversations based on their unique financial goals.

Learn More

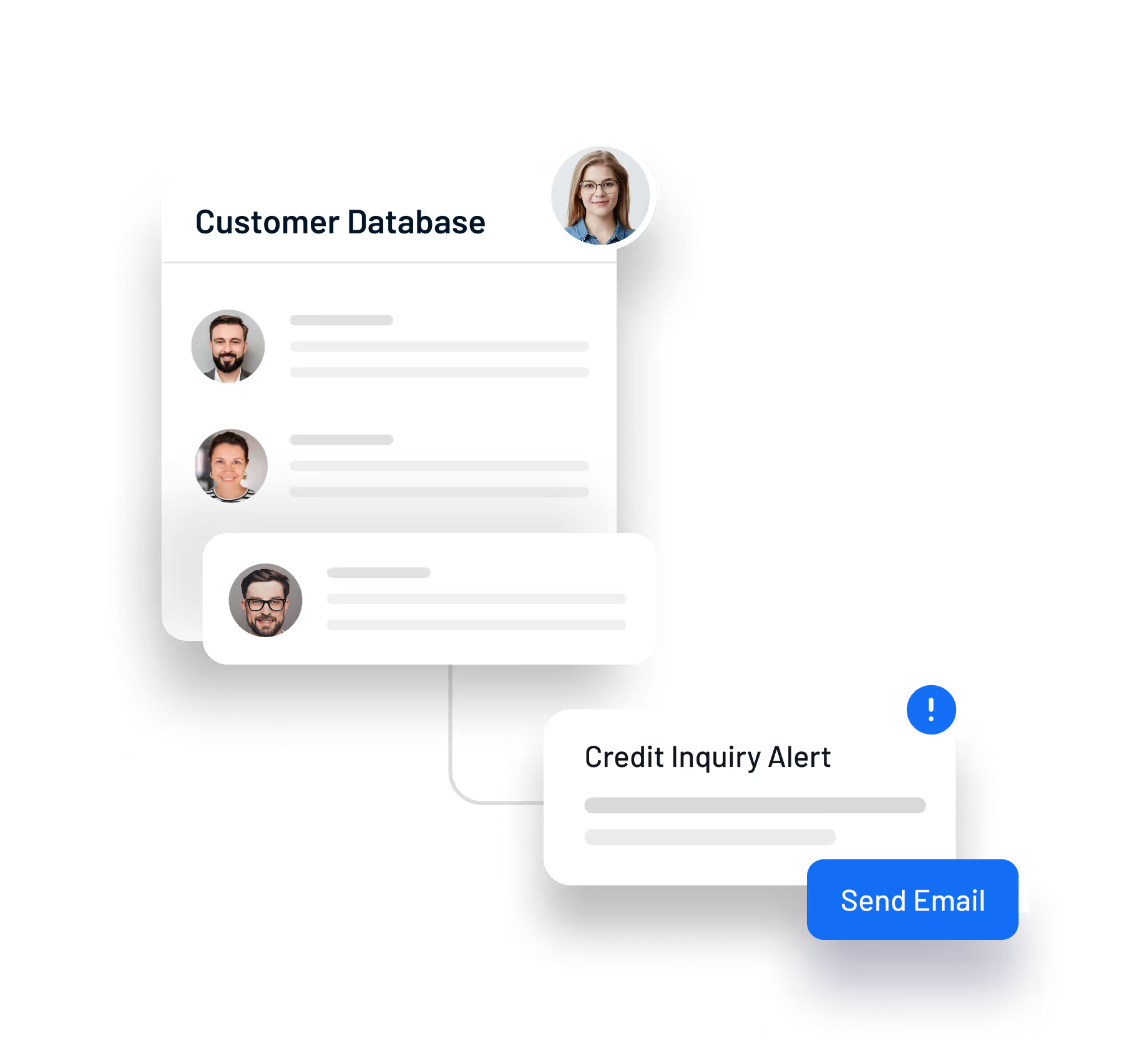

Insights + Alerts

Don't leave your data in the dark

Engage customers at the moments that matter with real-time data monitoring and automated alerts for events that drive financial decisions.

Life event insights

Know the moment your customers experience a major life milestone so you can connect in the moments that matter.

Activity alerts

Get automated alerts for credit inquiries, rate qualifiactions, equity thresholds, and property listings.

Learn More

Contact Segmentation

The right audience, the right message.

Right now.

Right now.

Define your target audiences, surface high-quality opportunities, and deliver truly personalized Journeys for every consumer.

Functional filtering

Quickly sort, serach, and select contacts based on their financial activity and relevant data.

Better ROI

*https://www.gartner.com/en/marketing/insights/articles/tap-into-the-marketing-power-of-sms

Learn More

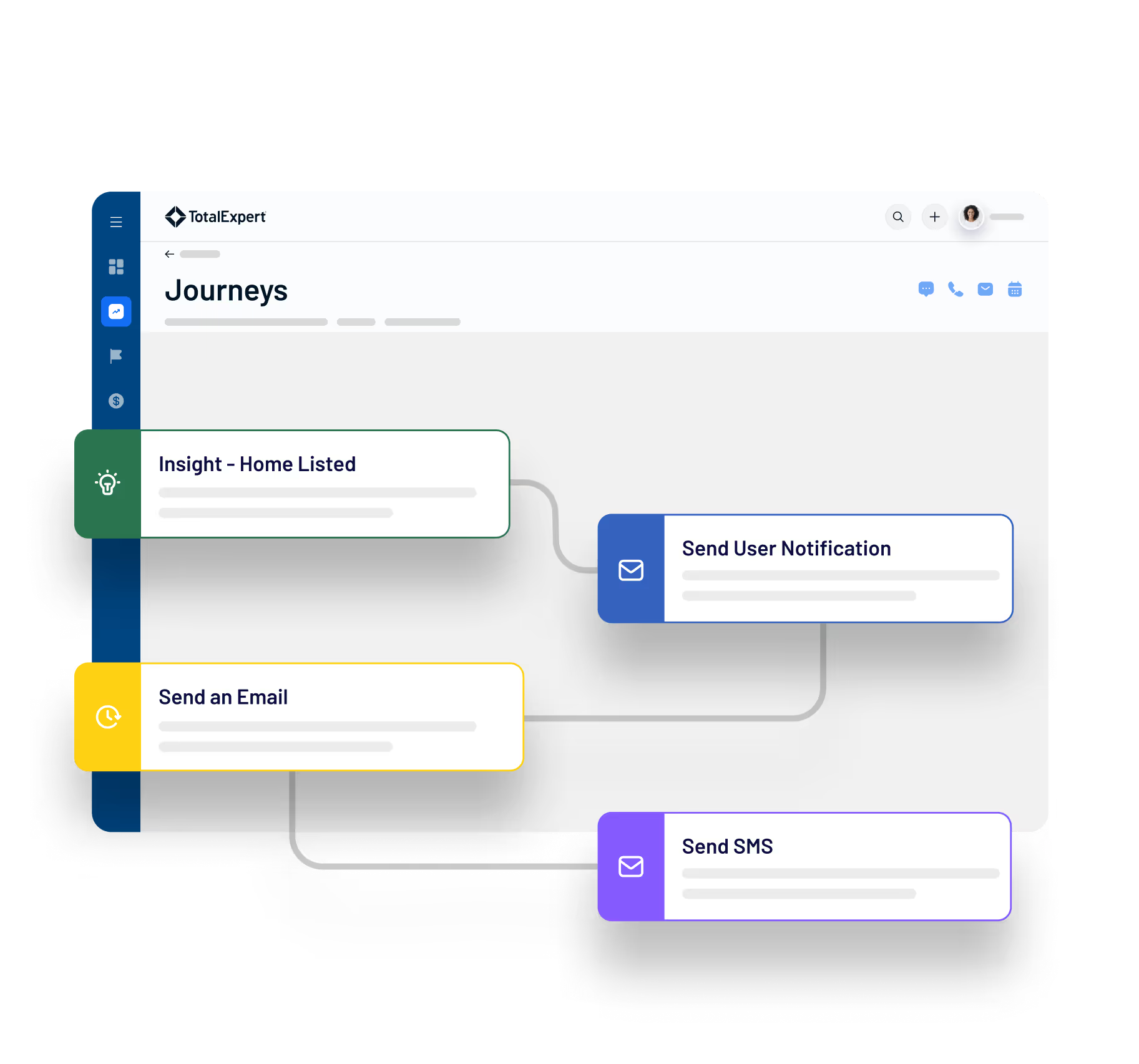

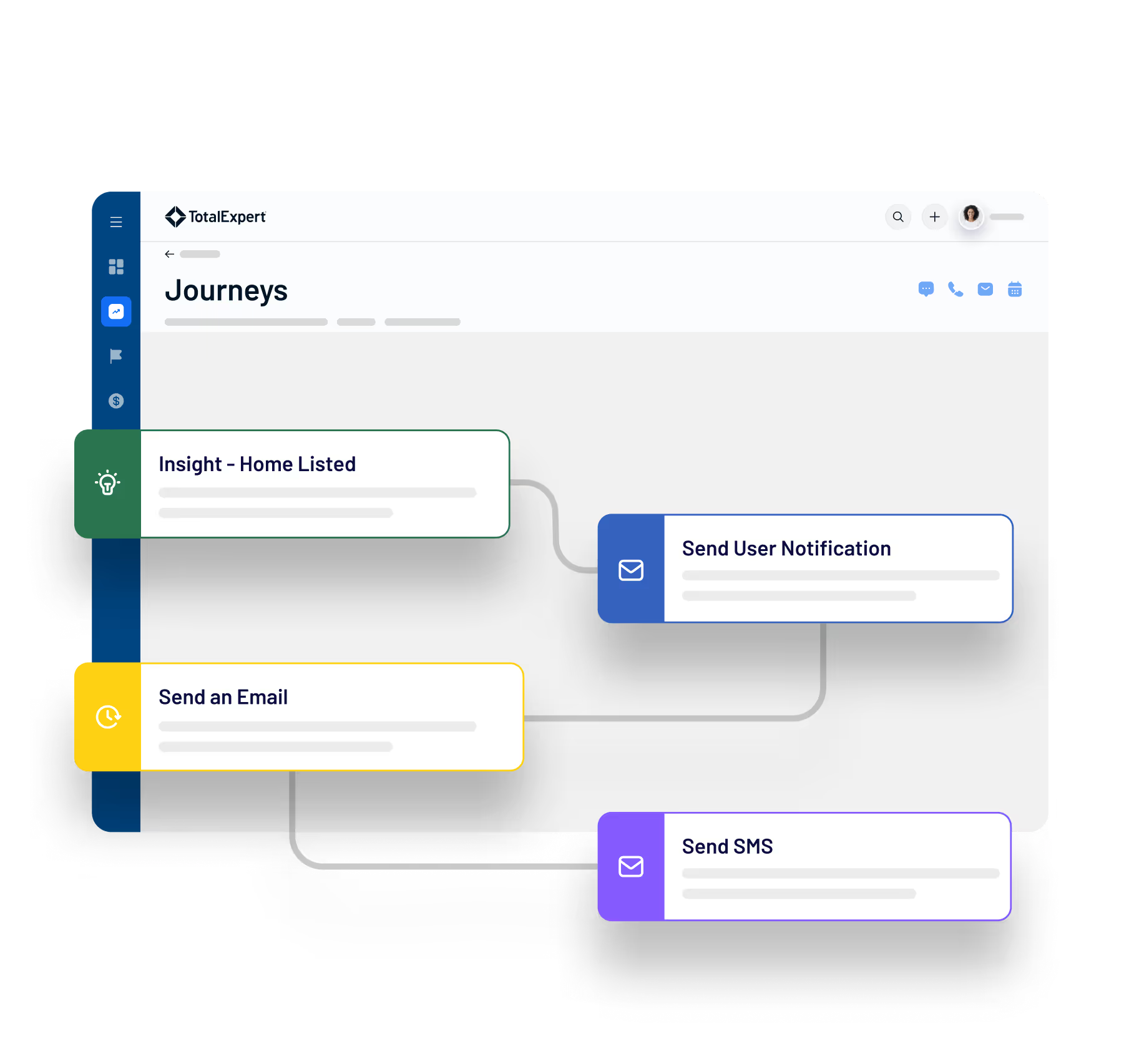

Dynamic Journeys

Deliver the perfect customer journey

Create seamless customer experiences across every channel with a mix of automated digital engagements and human outreach.

Personalization at scale

Pull contact-level data into every communication to deliver truly personalized experiences.

No missed opportunities

Automated, always-on campaigns ensure that no contact slips through the cracks.

Learn More

MORE THAN A PLATFORM

We’re here to support your people and your goals

Tools and technology are only as effective as the people who use them. That’s why we provide dedicated support, expert guides, and education resources for every customer—all from a team that’s deeply passionate and knowledgeable about banking and lending.

Services overview

Dedicated Support

Get the help you need from our support and customer success teams.

Professional Services

Make the most of your investment by tapping into a team dedicated to your success out of the gates.

Education & Guides

Elevate your sales and marketing approach alongside a team built to ensure adoption and success.

INDUSTRIES WE SERVE

Purpose-built for modern financial institutions

Total Expert isn’t just a one-size-fits-all CRM. It’s an intelligent automation and engagement platform designed to help lenders, banks, and credit unions deepen relationships and drive growth in any market.

Schedule a demo

Mortgage Lending

See how Total Expert helps lenders and loan officers identify opportunities, boost engagement, and win customers for life.

Explore Mortgage Lending

Banking

Learn how Total Expert helps banks stay connected with customers and support them across every financial milestone.

Explore Banking

Credit Unions

See how Total Expert empowers credit unions to serve and support their members throughout their financial journeys.

Explore Credit Unions

Insurance

Learn how Total Expert enables insurers to create trusting relationships that grow along with customers' insurance needs.

Explore Insurance

Resources

Knowledge & insights

See Total Expert

in action

Create sustainable growth and increase loyalty with a customer engagement platform that’s purpose-built for financial institutions.